-

Posts

605 -

Joined

-

Last visited

-

Days Won

3

Content Type

Profiles

Forums

Events

Gallery

Store

Blogs

Posts posted by Macshimmy

-

-

-

"The terms negotiated with Sports Direct represent the optimum combination of quantum and duration of funding, allowing the company time to arrange permanent capital which can be used for strengthening the playing squad."

"The terms negotiated with Sports Direct represent the optimum combination of quantum and duration of funding, allowing the company time to arrange permanent capital which can be used for strengthening the playing squad."

"The terms negotiated with Sports Direct represent the optimum combination of quantum and duration of funding, allowing the company time to arrange permanent capital which can be used for strengthening the playing squad."

They're dead Al, why havent I leaped yet?

0 -

Anyway, the FT article might be good news (of sorts) as you would know if you'd read it rather than making snide comments.

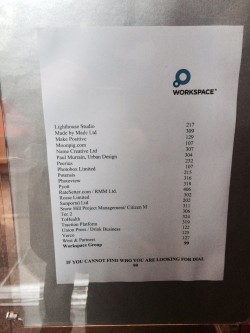

It's behind a paywall so here:Ok, go down this alphabetical list of corporate tenants at the front door of a shabby office block in south London. You’re looking for the name “Worthington”. Click to enlarge if needed…

It’s not there, right? And the guy at reception hasn’t heard of “Worthington” either. Which is strange when this address — 30 Great Guildford Street, London, SE1 0HS — is listed on the Worthington Group PLC website as being the company’s “Central London Office.”

Our initial thought on this was that perhaps the company had moved already to bigger premises – something more befitting the global conglomerate Worthington is threatening to become. But it subsequently turned out that 30 Great Guildford Street is home to Fresh Business Thinking, an events and digital media business that recently became part of the seemingly fast growing Worthington family.

Having had its shares suspended for three months, this company, with a main London listing, revealed on Friday night that the Financial Conduct Authority had decided Worthington would have to issue complete details of the investments it was planning in the form of a full blown prospectus. Much to Worthington’s dismay, the FCA had decided that since these investments would produce a fundamentally different company, these transactions constitute a reverse takeover. Hence the need for a costly and time-consuming prospectus.

Despite its current small size in terms of market capitalisation (£12.6m) it’s worth spending a moment considering what Worthington was and what it might become.

First, on the plans going forward…

Yes, the company has declared, in a regulatory news statement, that once it gets these deals done across five continents and six sectors, net assets per share will be six or more times the pre-suspension market price (87p) and that consolidated assets for the company as a whole will have grown from £5.5m at the last available balance sheet date (March 2014) to circa £1.3bn.

The Company has already begun work on the prospectus and will seek to complete it as soon as possible. Once completed, and the application submitted, shares are expected to subsequently resume trading in London and also be traded in Frankfurt, Stuttgart and New York.

Following successful completion of the acquisitions, the Company will have substantial interests in litigation funding, media, clean energy, mining, oil and gas and property. Geographically, the Company will have significant investments in the United Kingdom, Australasia, Africa, North America, and India. Consolidated net assets of the group, following conversion of loan notes used to finance investments and before minority interests, are expected to exceed US $2 billion and generate net profits in excess of US $20 million in the first full year following acquisition, with substantial growth expected thereafter. Net assets per share, after financing costs and on a fully diluted basis, are expected to substantially exceed £5 per Worthington ordinary share.

So where has Worthington come from?

After 58 years on the London stock market, by the summer of 2012 Worthington had shrivelled to become a near-dormant investment company, with a troubled property development on contaminated land at Keighley, near Bradford, and a yawning pension deficit.

Enter Doug Ware.

Described (by himself) as an incisive and energetic businessman, with extensive experience across various sectors running both publicly listed and private companies, Ware became chief executive, got rid to the old board and brought in two non-executives, Richard Spurway and David Simpson.

While Simpson soon resigned, Ware and Spurway moved to try and stabilise the business: the land at Keighley was sold for about £500,000 (against a book value of £4m) and arrangements were made to possibly transfer the pension scheme (which had previously made the mistake of lending £3m to Rangers FC before the club went into administration) to the official pension bailout mechanism, the Pension Protection Fund. These initiatives pushed pre-tax losses to £5.3m in the year to end-September 2013, with losses on the retained earnings line growing to £26m. In November 2013, the shares were suspended as Ware and his team sought additional funding.

And then something truly transformational happened.

Earlier, in April 2013, Worthington had paid £250,000 in the form of unsecured loan notes for a 25 per cent stake in a company called Law Financial Ltd, which was described as…

The company also acquired an option to buy the remainder of LFL for £750,000 (again in loan notes) which Worthington then exercised in October that year.

…a recently incorporated company with a number of subsidiaries, one of which owns ongoing legal claims against the assets of Rangers Football Club Limited.

With LFL fully consolidated, Worthington then slapped a fair value of £10m on the assets it had just acquired for £1m (with loan notes) and booked a “gain on bargain purchase of £9,034,000 in the period.”

Suddenly, for the six months to the end of March, 2014, Worthington was able to declare a profit of £8.7m.

Magic.

The mysterious vendors of LFL, having apparently sold an asset at 10 per cent of its value, seem to have been motivated by 20m warrants attached to those loan notes. By now warrants over 35m Worthington shares were in circulation, exercisable at 5p apiece.

It was now time for Ware to get the shares relisted and enact his master plan, with trading finally resuming on August 29, last year, which is when things really began to motor….

September 1 Worthington Group back Rare Earth Mining exploration as world struggles to fill supply gap in potential $8bn global Rare Earth Elements’ marketplace

September 10 Worthington Group to expand global legal claims business with acquisition of £43m legal claim.

September 22 “Potential major Oil & Gas investment” and “first media investment within the next seven days.”

September 26 More rare earth investment in Greenland

September 29 Worthington Group to acquire digital media, events and branding portfolio, including The Digital Marketing Show and Essential Cyclist online

October 2 Agreement to invest £12.5m in CPS Energy Resources Plc, an oil and gas exploration company focused on Africa

October 6 Head of acquisitions appointed, along with a head of the new oil and gas division

October 8 Worthington is already in a position to offer an upbeat trading statement, along with news of the acquisition of two further litigation claims, a clean energy company, a private mining company, along with “the acquisition of majority stakes in oil and gas producing assets.”

At which point the Worthington juggernaut came to a juddering halt.

Three months on, we now know that the FCA very much classes all this apparent activity as constituting a reverse takeover. And how long we might have to wait for the required prospectus is difficult to say. In the meantime, it is worth going back to look at how Worthington sees a couple of these new business lines operating.

The Company requested the temporary suspension of its shares on the 10th October 2014 in order to consult with the FCA about whether any of the transactions announced either on 8 October, or previously, or which are currently being contemplated by the Company could be classified as a reverse takeover.

The Company will make a further announcement before the end of this week.

- – - – - – - – - -

Legal claims

The £43m litigation claim mentioned above involves two unnamed European companies who are claiming a loss and breach of contract by a Chinese client involving the development of a series of university campuses in China.

The idea is that the claimants pay Worthington a fee of £125,000 and the company then hires specialist legal counsel to assess the quality of the claim and offer a percentage probability of successful litigation.

- If the chances of success top 60 per cent, at a claim value of £43m, Worthington will issue 1m new shares to the claimant companies.

- If the claimants can get an English court finding in their favour with this Chinese claim, Worthington will grant a further £1.5m in stock to the claimants.

- If the claim brings a successful judgement in China the claimants get another £3m of stock; and

- If there’s a successful enforcement of the judgement, and Worthington gets £43m in cash or property, Worthington will then issue a further £5m in stock to the claimants.

The company reckons this approach produces a whole new legal claims division, with stock being used as a claims acquisition currency. Also…

Worthington is particularly attracted to the legal claims market because there are essentially only three outcomes: Win, lose or settle – which is in contrast to most business propositions where outcomes can be affected by many more factors which are outside the control of management.- – - – - – - – - -

Oil and gas exploration

On October 2, Worthington said it wanted to invest £12.5m in CPS Energy Resources,described at the time as an exploration company focused on Africa, working in partnership with Jo’Burg-listed Oando. The new CPS stock was to be priced at “27.5 per cent of the agreed likely stock market value of CPS (i.e. a discount of 72.5 per cent) when, as expected, it lists in 2015.”

There was evidently (and understandably) some confusion over this at the time, drawing a clarification from Worthington:

This means that, prior to investing, Worthington needs to be satisfied that the expected value of CPS on listing will result in a gain of more than £30m to Worthington. The final decision to invest, in the light of the comparable valuations, will be taken by Worthington in association with the German and Swiss institutional investors who are funding the purchase.What seems to be happening here is that existing holders of convertible Worthington loan notes — those unnamed German and Swiss institutional investors — have agreed to convert, sell the stock, and then lend the proceeds back to Worthington so it can play in the E&P business.

- – - – - – - – - – -

We could go on, but you’ve probably got the picture by now. Worthington is like no other company we’ve seen on the public markets.

If and when Worthington ever comes back from suspension it will not just be in the litigation funding, media, clean energy, mining, oil and gas and property industries. First and foremost it will be in the business of printing shares.

This entry was posted by Paul Murphy on Tuesday January 13th, 2015 13:02.Journo is one "Paul Murphy" though.

0

0 -

Some awesome scooping going on In here tonight lads, keep up the good work.

0

0 -

Here's the Financial Times doing some digging - all sounds very much like 'wealth off the radar' action:

http://ftalphaville.ft.com/2015/01/13/2085432/a-worthington-tale/

Could be the markets will spike it, it's the kind of thing which gives them a bad name 0

0 -

Here's a bit more insight from Private Eye (who aren't often wrong - they can't afford it!) regarding the relationship of the entities involved:

Rangers

It is ever harder to believe that the recent events off the pitch at the Glasgow club can be happening at a public company - even one that owns a footbal club.

Wihin days of the police arriving at doors connected to old Rangers saviour Craig Whyte, new saviour Charels Green and his adviser Imran Ahmad are out the rangers door and Green is looking to sell his shares to the brother of a man convicted of VAT fraud.

Meanwhile wyte, once disqualified from being a director, claims that he and Green were secret partners all along, together with Whyte's twice bankrupted business partner Aidan Earley.Whyte now threatens a legal claim on the 'oldco' Rangers assets acquired by the 'newco' Rangers floated last year.

Amid all this, a perhaos more important question concerns the potential pillaging of a pension fund controlled by Worthington Group, another listed company linked to Whyte and Earley. That is the same Worthington Group that is now backing threatened litigation by Whyte over the Rangers assets.

Worthington is a textile-turned-property business which was run until 2010 by Joe Dwek, well known in Manchester business circles since the 1970s. Back in the day, Worthington acquired another former listed textile business, Jerome Group, which had a large pension fund; in 2010 this had assets of just over £8 million. But again, like many similar old companies, that pension fund had a deficit of liabilities to pensioners over those assets of almost £3 million.

In 2010 both Whyte and Earley's older brother Wulstan moved on Worthington. Whyte and Aidan Earley had form for targeting struggling companies with pension fund cash. In 2002 they made moves on FII, the former Lotus shoe group. The pension trustees were so alarmed that they alerted the Companies Investigation Branch, which began making inquiries. The threat went away. FII collapsed in 2004, largely due to the pension deficit.

Regenesis Holdings (owned by Wulstan Earley) and then Whyte's company Libert Capital each built up big stakes in Worthington. Regenisis began buying in February 2010 and has 23 per cent by that August, when Liberty Capital revealed it owned 7.5 per cent. Dwek resigned from the board , which was joined by a nominee from Regenisis, Peter Townsend.

Soon Whyte was looking to buy Rangers from Sir David Murray.That deal was completed in June 2011 with the involvement of Aidan Earley and the use of rangers' own funds, via an advanced ticket-sales deal of almost £18 million. Whyte has been ordered to repay that money to the ticket agency, Ticketus.

New Worthington chairman Anthony Cooke informed shareholders in July 2011 that the investment managers of the Jerome fund had been changed, that its low-risk bond holdings had been sold for £ million and that a 'significant portion' of the fund's £3.3 million cash was 'earmarked' for a specific investment.

That was revealed in March 2012 to have been a far from low-risk loan to a near-bust Rangers. Somehow the pension fund trustees had agreed to effectively lend £2.95 million to Worthington shareholder Whyte. Even if this loan was to have been fully secured, it is hard to see how that was a prudent investment - especially for a pension fund that by March 2012 had a £3.9 million deficit and assets of only just under £8 million.

But at that time Whyte was desperate for funds to save Rangers, under siege from the taxman, from administration.

The £2.95 million, instead of being held to the order of the trustees, pending completion of the loan documentation, had been paid over by Rangers/Whyte's solicitors Collyer Bristow to the club before it collapsed into administration in February 2012. The money is now frozen and and the subject of litigation with the old club's liquidators and could go to pay creditors rather than pensions.

The pension fund trustees claim they acted on legal and independent advice that the proposed loan was appropriate. But who gave that advice, who the new investment managers were and who are the trustees all remain unclear.

In June 2012 Cooke, Townsend and a third director resigned, to be replaced by a photographer-turned-property man Douglas Ware and barrister David Simpson. Ware declared that he believed the Rangers loan had represented 'an attractive opportunity' for the pension fund and was in the 'best interests' of both the fund and Worthington., and that he was confident the claim to recover the money would succeed.

Such confidence is perhaps not surprising - Ware and Adian Earley go way back. They were both directors of Anglo European Holdings in 1993 and Ware was a director of FII, in which Earley and Whyte held shares, for three years before it collapsed in 2004.

Whyte and Liberty Capital sold down, if not out, of Worthington last year, but Ware and Worthington are still there to help. Worthington invested £250,000 in a brand-new Whyte venture, Law Financial, which is funding (with the help of a conditional fee agreement) the threatened legal action against Green and Ahmad.

Law Financial was formed only on 12 March. Whyte is its only director. Meanwhile, barrister Simpson resigned this year, to be replaced by Richard Spurway, another former FII director.

Events at Rangers are serious. But the fate of almost half the Jerome pension fund should perhaps trigger their own investigation by City regulators into what has happened at Worthington, whose shares are, at just under 5p, a third of what they were last year."Shadier, and Shadier!

0 -

Is the info I am posting old hat?

Or right in your face, plagiarism?

It's been turned over before, but its difficult to assess the significance.

The company at the heart of the 'ownership' saga, Worthington appeared dead until the end of last year, and the claims looked spurious.

They quietly 'phoenixed' in December, and in the last few days posted this to the Stock Exchange:

Worthington Group PLC

09 January 2015

Worthington Group plc ("the Company" or "Worthington")

9(th) January 2015

FOR IMMEDIATE RELEASE

Update

Further to the company's announcement on 12(th) December 2014, the FCA have now issued the company with guidance in relation to the transactions that the company asked the FCA to review pursuant to Listing Rule 5.6.4 (Reverse Takeovers). In the opinion of the FCA, following these acquisitions, the Company is, or will be, a fundamentally different business and therefore the transactions constitute a reverse takeover. Whilst the Company believes the arguments are finely balanced (in the Company's view, Worthington was an investment business prior to the transactions and will remain one following the transactions), the Company respects the FCA's view on this. Therefore, the Company's original request to suspend trading in the Company's shares remains in place pending a re-application for listing of the Company's shares and the issue of a prospectus.

The Company has already begun work on the prospectus and will seek to complete it as soon as possible. Once completed, and the application submitted, shares are expected to subsequently resume trading in London and also be traded in Frankfurt, Stuttgart and New York.

Following successful completion of the acquisitions, the Company will have substantial interests in litigation funding, media, clean energy, mining, oil and gas and property. Geographically, the Company will have significant investments in the United Kingdom, Australasia, Africa, North America, and India. Consolidated net assets of the group, following conversion of loan notes used to finance investments and before minority interests, are expected to exceed US $2 billion and generate net profits in excess of US $20 million in the first full year following acquisition, with substantial growth expected thereafter. Net assets per share, after financing costs and on a fully diluted basis, are expected to substantially exceed GBP5 per Worthington ordinary share.

The Company is in the process of preparing its audited accounts to 30(th) September 2014 and expects to hold its AGM towards the end of March 2015. The AGM notice and accounts will be available on the Company's website in due course.

Commenting on the news, Doug Ware CEO commented "Whilst ideally we would have liked to avoid triggering a reverse takeover, we respect the FCA's decision and will press ahead with completion of the Company's prospectus. I'm delighted with the progress that we have been able to make with these acquisitions and our pipeline of investments continues to grow. I would like to express my thanks to our shareholders for their patience and support during this process. In addition to these investments, the acquisition team will continue to progress new transactions which we believe will add further to shareholder value but which, once having produced the prospectus, will not trigger any future RTOs."

What does that mean? F*cked if I know

0

0 -

Cant do linky thing to jambos kickback but it appears Ashley has the merchandising rights for Sarvers mob already

his US operation sells UK shirts over there - only big clubs mind:

0 -

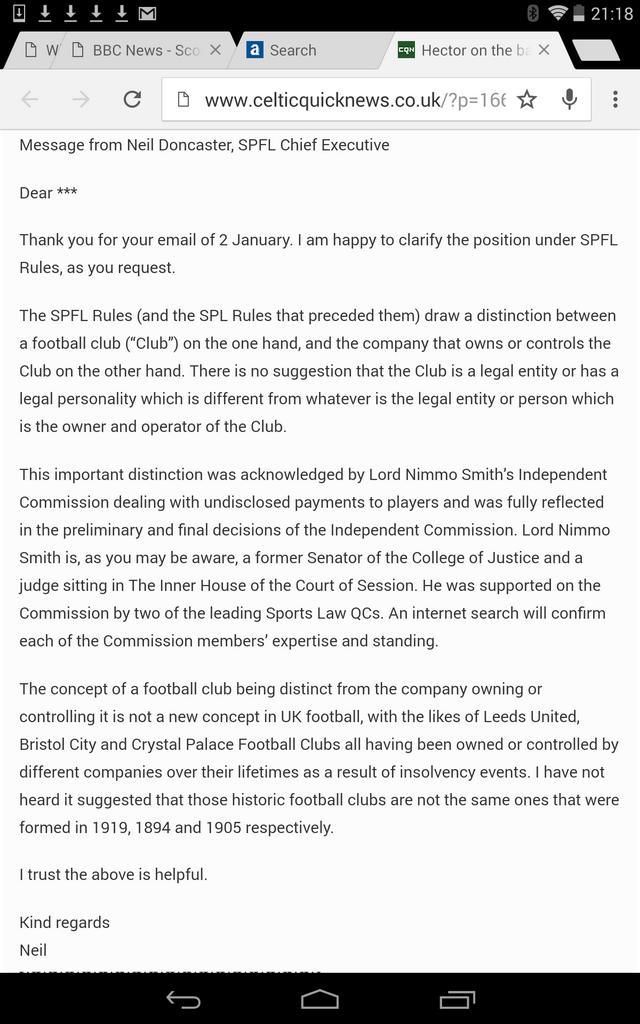

Paul been busy writing emails.

Telt!

Heroes and Villains (1996)

Trigger, Del, Rodders, Sid and Boycie chating in Sid's cafe. Trigger has just been presented with an award for saving the council money.

Trigger And that's what I've done. Maintained it for 20 years. This old brooms had 17 new heads and 14 new handles in its time.

Sid How the hell can it be the same bloody broom then?

Trigger Theres the picture. What more proof do you need?

0 -

Right there shows the SFA that Ashley has influence in the running of the club right out in the open. This right in front of the SFA even with a hearing on the 27th January. Now all this is under appeal, so what is Ashley's game plan, is there an end game?.

What can the SFA do to stop him over the next 22 days?

And all the time the club is ailing and struggling to pay maintenance costs.

Could Ashley be on the verge of holding the club to ransom looking for as Tedi said a way out, but in a way that he gains big time. He is owed 2m by the club and anyone that wants to take control of the club will have to pay him back, then there's the other assets held by Ashley which I'm sure he will not part with for the usual £1.

Seems to me that the minute he signed that deal which gave him two directors on the board, he was already on plan 'b'.

Llambias doesn't count as one of those - he was appointed freely by the board. Somers knew he was toast without Ashley, so he's Ashley's creature too.

He's got one more to go, and then the board is pretty much his.

Supposing he is working with the American - with the intent of buying the Easdale's stake and their proxies? That would give him effective control, without breaching the one concrete stipulation of the SFA's conditions.

The other clause "not to exercise undue influence on the boardroom." seems vaguely defined.

Do we know any more about the SFA's restrictions?

0 -

Richard Wilson apparently saying that Ashley will negotiate to leave but will want to keep his retail deal. some amount of influence from the 10%er....

He must know that no bears/hardly any will buy his merch if the current deal remains in place.

It's not so straightforward. The revenue streams which Ashley diverted are actually hived off into a company called Rangers Retail,

which is nominally under the control of the club:

TRFC has stock majority in Rangers Retail, with 51 per cent of the shares against Sports Direct's 49 per cent.

Control of that company rests in the hands of its own board of directors (two representatives from Sports Direct, two from the club.)

Appointing Leach as a director of Rangers would allow him to count as one of Ranger's representatives on the board of Rangers Retail,

giving Ashley absolute control, and presumably the ability to alter the deals as he sees fit.

Nevertheless, you can be sure the company holds exclusive rights, so if you boycott them you won't have a strip at all!

0 -

Doesn't that clown in the front row look familiar?

0

0 -

So why did HMRC threaten a winding-up order?

because Hector is a wind-up merchant?

0 -

Can't be added reading through around teb pages or so, so a bit of devils advocate....

Have I missed anything?

You've misunderstood the phrase 'devil's advocate' methinks. Still, the historical etymology may be oddly fitting to the Rangers pantomine:

Definition of devil's advocate: noun (composited)1A person who expresses a contrary position to their own in order to provoke debate or test the strength of the opposing arguments:

1.1 historical A person appointed by the Roman Catholic Church to challenge a proposed beatification or canonization, or the verification of a miracle.

Which Saints have you performed this duty for though?

C̶r̶a̶i̶g̶

̶C̶h̶a̶r̶l̶i̶e̶

̶G̶e̶o̶r̶g̶e̶

̶M̶i̶k̶e̶

̶Dave?

0 -

ICT's turnover is up 300k, a humble profit of 22k but that's improving on a loss of 400k the previous season.

Better yet, admin costs have been reduced by 110k, so we aren't carrying much fat.

First profitable year since 2007.0 -

There is a game of chess being played with Rangers just now

Nah. This isn't chess. This is Jenga, or possibly Snakes and Ladders.

0 -

("Rangers", "RIFC" or the "Company")

Statement re. Possible Offer and Rule 2.10 announcement

The Company notes recent press speculation and confirms that it has received an approach from Robert Sarver (or a vehicle to be established and controlled by him) ("Mr Sarver") that may or may not lead to an offer being made for the Company. There can be no certainty that an offer will be made, nor as to the terms on which an offer may be made. A further announcement is expected shortly.

Rule 2.6(a) of the City Code on Takeovers and Mergers (the "Takeover Code"), requires that Mr Sarver, by not later than 5.00 p.m. 2 February 2015 (the "relevant deadline"), either announces a firm intention to make an offer for Rangers in accordance with Rule 2.7 of the Takeover Code or announce that he does not intend to make an offer, in which case the announcement will be treated as a statement to which Rule 2.8 of the Takeover Code applies.

The relevant deadline will cease to apply to Mr Sarver if another offeror announces, prior to the relevant deadline, a firm intention to make an offer for Rangers. In such circumstances, Mr Sarver will be required to clarify his intentions in accordance with Rule 2.6(d) of the Takeover Code.

This is an announcement falling under Rule 2.4 of the Takeover Code and does not constitute an announcement of a firm intention to make an offer under Rule 2.7 of the Takeover Code. There can be no certainty that an offer will be made nor as to the terms on which any offer might be made.

A further announcement will be made as and when appropriate.

Rule 2.10

In accordance with Rule 2.10 of the Takeovers Code, the Company confirms that it has 81,478,201 ordinary shares of 1 pence each in issue.

0 -

Rangers International Football Club plc

("Rangers", "RIFC" or the "Company")

Credit Facility of £0.5 million

The Company is pleased to announce that it has entered into a short term credit facility for up to £0.5m (the "Facility"). The Facility is being provided by Alexander Easdale, a shareholder in the Company and director of The Rangers Football Club Limited, the wholly owned subsidiary of RIFC. The Facility will be used by the Company for general working capital purposes over the next few days.

Alexander Easdale will make available to the Company up to £500,000 on a fee and interest free basis and it will be secured against the income from the sale of player announced on 2 January 2015.

Under the AIM Rules for Companies, the Facility is a related party transaction under Rule 13 of the AIM Rules. The Directors of Rangers, having taken advice from their nominated adviser, WH Ireland plc, believe that the terms of the Facility are fair and reasonable as far as shareholders are concerned.

Ends

For further information please contact:

Rangers International Football Club plc Tel: 0141 580 8647

David Somers

0 -

The truth is nobody knows Ashley's motivations.

The cash to be made at Rangers is such a pittance compared to his other interests, that I would hazard he got involved because he likes playing exactly this kind of game.

He broke his sports-goods competition by infiltrating their price-fixing cartel (fixing the price of football shirts, of course) and then once he was in, turning whistleblower.I don't think Admin is his plan, but the threat of it might be an effective way of replacing some more beams and pillars at the club.

0 -

I can think of a few other reasons why their shares might have been suspended (off the top of my head, plenty more possibilities.) Some are more amusing than others.

- News of Material Significance to investors - infinite ways of spinning that - delaying tactic from Ashley? The U.S. Cavalry?

- The LSE has found a rat - price manipulation, acting in concert, account irregularities

- Admin is Ashley's weapon of choice.

0 -

On the Ashley issue - he has effective control right now, no?

He also has his hands on some of the most important income streams - and thus I would say he still has the club by the balls.

Maybe he'll just let go like the noble hedge fund tenders?0 -

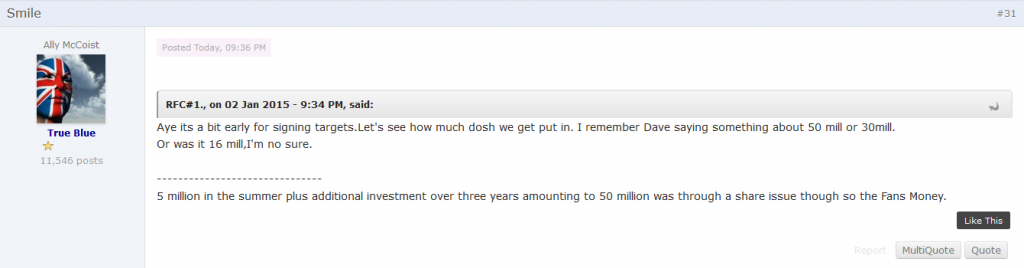

I haven't seen any war chest wankery just optimism and unless uncle mike sells Newcastle then he's stuck at 10%.

Exhibits A, and B:

0

0 -

King and the three bears have around 35%, the fans/small shareholders have around 15% (?) Can anyone confirm that? There may also be other shareholders with the best interests of the club....

Seems a bit premature for the warchest wankfest currently under way amongst the Sevconions if you ask me, there is no indication that any of the factions Bennett lists above actually are acting together, and on previous form it's more likely the 'Three Bears' and King are fighting over the carcase.

Does Mike Ashley strike you as the kind of man to meekly hand over the keys, or torch the place?

I'm filled with equanamity, and a curious hunch that Doncaster may actually have dug a fresh grave with his comments.

Time will tell.

0 -

Meanwhile, in an alternate dimension:

0

0

Most Hilarious Rangers/Sevco Moment So Far

in Celtic v Rangers, Rangers v Celtic

Posted